Digital platforms challenge incumbent companies and make incredible profits. Apple, Uber, Netflix, YouTube and so many other digital platform companies demonstrate insolent exponential growth. What is their strategy and business model? Indeed, Michael Porter’s 5 forces in competition face criticism with this new economy and are seen as having limitations. Even, some people say that the Michael Porter’s 5 forces are not relevant any longer. So, is this strategy model obsolete or is it possible to make it embrace this new digital platform economy? How to use this model in the platform economy?

- What are the Michael Porter's 5 Forces of competition and a competitive advantage?

- What is a digital platform?

- What are the 5 Forces of Coopetiton in platform economy to take into account to build a digital platform strategy? How do they interact and differ from the 5 Competitive Forces in traditional market?

- What’s next? Learn more about platform and digital!

- Do you want to learn more about Digital Platform? Here are some valuable references

What are the Michael Porter’s 5 Forces of competition and a competitive advantage?

The Porter’s 5 Competitive Forces

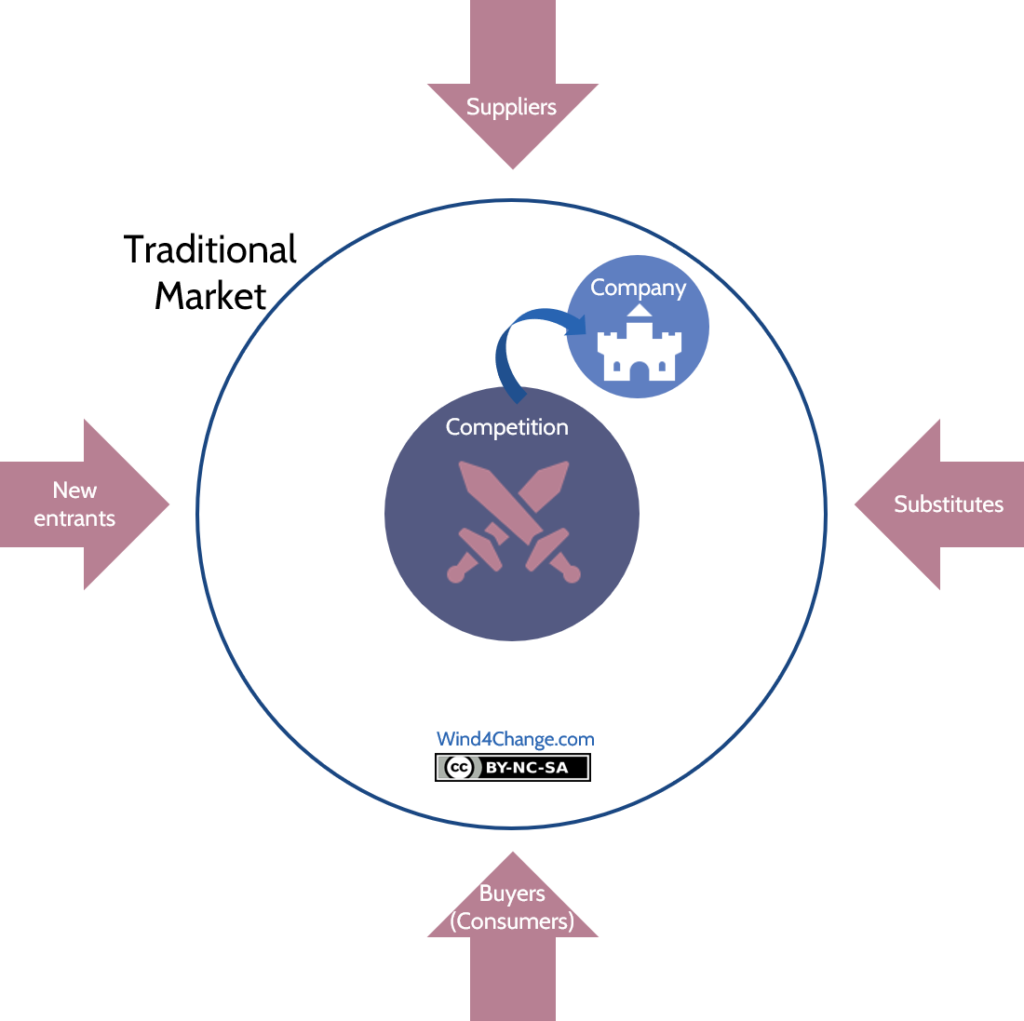

As we have reviewed in my post about competition and competitive advantage, there are 5 competitive forces in traditional market. The stronger these forces, the less attractive and profitable a market is:

- The competitive rivalry: the current level of competition in the market between competitors.

- The bargaining power of customers: are they price sensitive? Are they in a powerful position to push the prices down?

- The bargaining power of suppliers: are the suppliers powerful and able to charge high prices then cutting profits for the company?

- The threat of substitutes: what are the other products or services that can address the customer basic needs and how do they cover these needs?

- The barriers to entry: how hard it is for a new entrant to get into the market and to capture market shares?

To face these competition forces the company has to move away from the competition pressure by being different. This can be achieved in two ways proposing:

- First, a different product or service allowing the company to charge a price premium.

- Second, a better price thanks to a reduced number of features but still meeting the customer needs of the targeted segment.

In addition, the creation of a new market, a blue ocean, is another option but the competition will eventually enter it, so it is a temporary option.

The Porter’s Competitive Advantage

The 5 forces of competition come with the notion of competitive advantage. In order to be able to differentiate, a company should have and protect resources that are rare, valuable and hard to copy or substitute. Indeed, owning critical assets, that competitors cannot easily copy, gives the company a sustainable advantage. In addition, it enables the company to increase profits.

Yet, even for traditional market, the idea of sustainable competitive advantage is challenged except when created by government regulation like health or defense. An other reason is that the digital area with internet accelerates the instability of competitive advantage. Therefore, the solution is continuous innovation to keep differentiating and increase the value, the experience and the personalization to customers.

So, with digital platforms this model of the 5 forces of competition is questioned. Still, does it become obsolete or does it just need to be adapted?

What is a digital platform?

A digital platform, often shortened as platform, is an ecosystem allowing interactions between consumers and producers supported by matching mechanisms.

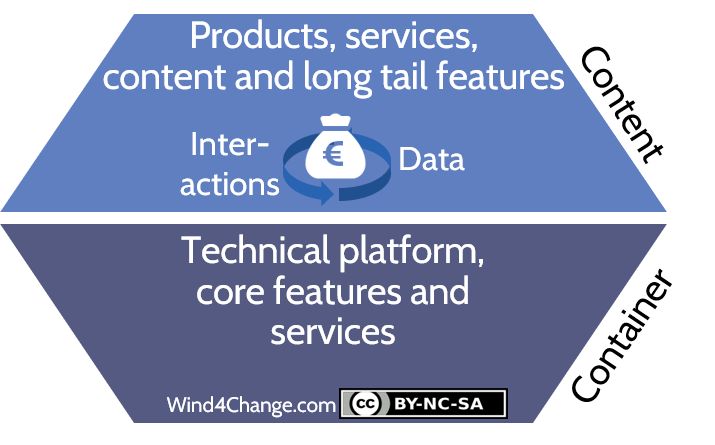

It is composed of 2 major parts:

- The Container is the technical infrastructure with the core features and services supporting the ecosystem.

- The Content that may be of various nature either information also called content, or products or services.

Digital platform business model

The platform is the foundation of the platform business model also called network orchestrator business model. Further, the platform is what enables exponential growth and cheap scaling by supporting external parties to interact with and contribute to the service and product offering.

Truly, the source of value of a platform is the network effect. Indeed, the more nodes, properly balanced between customers and producers, the more interactions then generating more value as data and monetizable transactions. Therefore, the critical asset is the community and the resources of its members.

To illustrate, a product without a platform is always less profitable and valuable than its equivalent supported by a platform. In fact, the average platform has a multiplier of 8×, compared with:

- 5× for technology creators such as software, analytics, pharmaceuticals, and biotechnology

- 3× for service providers

- 2× for product makers

Main lever for Digital platform strategy: coopetiton

Platforms expand the boundaries of the firm. Actually, competition becomes less significant in comparison to what collaboration, co-creation and coopetition can bring: exponential value and innovation. All the more so that cooperation is facilitated by the digital technologies. This leads to a shift from protecting value inside the company, the rare resources, to creating value outside the firm. Whereas the strategy for services or products is to create barriers to entry for competitors, the strategy for platforms is to create frictionless entry for producers and consumers.

To sum up, the critical factor is no longer ownership of rare resources but the community and related interactions. In fact, not owning tangible assets can be a way to decrease risk and improve profitability. Really, the most valuable asset is the community hosted in the platform.

Digital platform vs traditional product: example

Let’s illustrate with an example. In early 1997, only 7 companies controlled 99% of mobile phones profits with 4 of them owning 66% of the market shares: Motorola, Nokia/Microsoft, Sony Ericsson, Panasonic. These companies seemed at that time impossible to challenge on their protected market niches. In addition, they had large economies of supply. They had global market segments. Some, like LG, excelled at cost leadership, others, like Nokia and Blackberry, at product differentiation. Nokia alone had invested $40 billion in R&D over its history so it had the latest research.

In 2009, 1.5 years after introduction of the iPhone by Apple, Nokia’s market share peaked at 49%, but then fell to 2% only 4 years later. Six years after introduction of the iPhone, one company controlled 92% of global industry profits.

See my post about the new form of collaboration in digital to learn more about digital platform.

What are the 5 Forces of Coopetiton in platform economy to take into account to build a digital platform strategy? How do they interact and differ from the 5 Competitive Forces in traditional market?

Let’s review how to adapt the 5 Forces Competition Model of traditional market to the new platform economy.

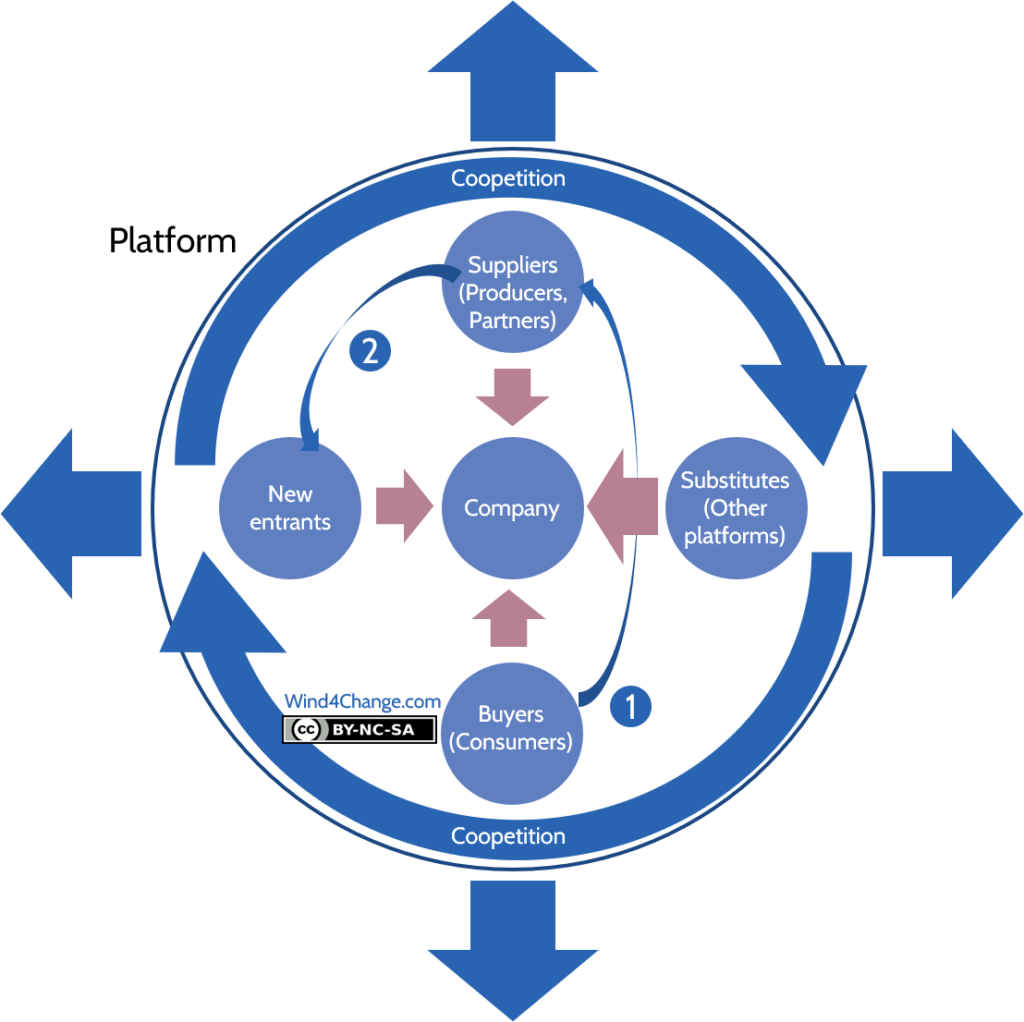

Coopetiton instead of competition

Digital platform strategy: coopetion force #1

In the platform economy, a new word has been coined, coopetion that mixes cooperation and competition:

- Cooperate, to make your overall market grows in size and value

- Compete, to have the best share of this market

If competition can have a positive impact on a company as it pushes for excellence and innovation, it is always something you have to fight against. However, coopetiton is different. It is ambivalent as it is a mix of cooperation and competition. To go beyond, it should be seen as a force that accelerates the market or here the platform ecosystem. It is a force that is influencing all the others in the ecosystem as all the other forces are to some extend playing by the rule of coopetion.

Consumers instead of buyers / customers

Digital platform strategy: coopetion force #2

At the digital age, the relationship with the customers of a product or a service is different as they want to contribute. The first level of contribution is by sharing a rich feedback on the product or service. Data is precious as in can be exploited to understand better the needs of consumers and then to generate more value to them.

Consumers’ feedback and contribution in platform ecosystem

Nevertheless, it is a double edge sword and can be an accelerator as a drawback for the market and the platform. As a matter of fact, feedback can be positive, accelerating or negative pushing out current or potential new consumers from the platform. When happy, consumers promote your brand on social networks and provide valuable feedback on your product or service. When ignored, frustrated, or disappointed they can create a public relation hell by sharing a bad experience on social media.

On top of delighting the consumers, the platform should engage them so they spend more time on the platform and invest in it. This is the second level of engagement where the consumers actually switch from their side as consumers to become producers (Arrow 1 in schema). As illustration, guests can become hosts on Airbnb, riders can become drivers on Uber and buyers can become sellers on eBay. Therefore, you can leverage them like the producers for their assets and contributions to generate value and or/innovation in the platform ecosystem.

Taking care of consumers in platform ecosystem

So what is the good approach to take care of your consumers?

- Listen a lot, for valuable input on their needs, on how to engage them more but also to demonstrate them interest.

- Give back as your consumers will contribute only as part of a win-win relationship. Contributors who spend their time, energy, and assets within your platform should receive a fair value in return. Value is not always monetary and can be:

- Prestige and reputation, like for LinkedIn article contributors,

- Information, like Yelp or TripAdvisor participants.

Producers / partners instead of suppliers

Digital platform strategy: coopetion force #3

This force quite illustrates how blurred are the boundaries within a platform. Indeed, your competitors may become partners in your platform to generate value and/or innovation: content, products, features or services. They contribute to grow the platform ecosystem, as they provide value they attract more consumers accelerating the network effect. Truly, the platform leverage the partners capacities either financial, human and innovation (R&D)…

Consequently, the partners should get a fair return on their investment even if the platform captures a part of this additional value. As a matter of fact, the rule is that a platform should always give more to its partners than it takes from them. This is mandatory for the platform ecosystem to keep expanding.

New entrants, sometimes producers becoming challengers of the platform

Digital platform strategy: coopetion force #4

We have seen that platform leverage partners to generate features and innovation. But to some point, as you always want to keep the relationship, the interactions with the consumers and related generated data.

Furthermore, you want to have the producers generate non critical features of the platform, also called long tail features. They should be complementors to the core of the platform. So this means that you should carefully watch the activity on your platform and new features and services proposed by producers. Those features may appear as long tail feature and leapfrog very quickly as essential features. You do not want them to put your platform at risk being like some sort of new entrant and proposing features or services becoming essential to the consumers (Arrow 2 in schema).

If it is the case, the platform should create a similar feature or buy back the feature from the producer so they have a fair benefit for their investment. Definitively, not doing so is taking the risk to disengage partners from investing in the platform and innovating.

Substitutes as other similar platforms

Digital platform strategy: coopetion force #5

Other platforms may overlap your platform and address part of your consumers’ needs. Platforms compete by trying to improve the quality of the service they deliver to attract in users, facilitate interactions, and match producers with consumers.

Platform multi-homing

As well, consumers and producers can be on several platform. This is what is called multi-homing.

- First, it comes with a cost like monetary (such as multiple subscription fees) or workload related (such as managing and loading data on several platforms).

- Second, at the same level of multi-homing costs are switching costs: those are the costs related to moving from a platform to another.

Platforms ambivalent relationships

Really, the relationship with other platforms is quite ambiguous. This is the reason the related red arrow in the schema is a little bit bigger as the relationship require more attention to manage.

- You want the consumers of these platforms to be connected to yours so they will generate activity and profits. Even, your platform should do everything so they switch from their platform to yours either because it innovates more proposing more functionalities or it is more user friendly.

- At the same time, you want your build some sort of barriers to prevent your consumers from leaving your platform ecosystem to move to a competing one.

This is the reason why you should continually observe the activity of other platforms, especially those that serve similar users. When a new feature appears on a similar platform, it may be a competitive threat, since users of your platform may find the new feature attractive enough to begin multi-homing or moving to the other platform. In this case you have two options: either to provide a similar feature directly or to indirectly through your platform partners.

What’s next? Learn more about platform and digital!

Check my other posts about digital:

- What is/are

- How does Agile fit in the Digital Revolution picture?

You can also learn more about Michael Porter Competition and Strategy Models for traditional markets:

Do you want to learn more about Digital Platform? Here are some valuable references

- The excellent book, Platform Revolution from Geoffrey G. Parker and Marshall W. Van Alstyne

- Another interesting book, The network Imperative from Barry Libert and Megan Beck

- A tough but still valuable post on current criticism regarding the Porter’s 5 Forces Strategy Model

- Statistics on mobile phone global market share from 1997 to 2014

Icons:

- Euro Money icon icon by Icons8

- Battle icon icon by Icons8

- Castle icon icon by Icons8