Value Volatility: Digital is more than the emergence of new disruptive technologies. It also involves a change of paradigm. And, the fourth one is the shift from from Stable Value to Volatile Value.

- Stable value and market position in traditional business

- Disruption in numbers with Digital Technologies and players

- Value Volatility: a Paradigm Change with Digital

- How to face the challenge of Value Volatility coming with Digital?

- What’s next? Learn more about Digital, the other new paradigms and the disruptive technologies

- Do you want to learn more about the Value Volatility? Here are some valuable references

Stable value and market position in traditional business

Traditionally, a firm’s value proposition was rather stable. To illustrate, products would be upgraded, marketing campaigns refreshed, or operations enhanced. But the core value a business offered to its customers was unchanged and defined by its industry (e.g., car companies offer transportation, safety, comfort, and status, in various degrees).

A successful business only needed to have a clear value proposition, to be differentiated in the market (e.g., price or branding) and to concentrate on delivering over the years the best release of the unchanged value proposition to its customers.

Disruption in numbers with Digital Technologies and players

What is disruption?

The first major theorist of business disruption was the Austrian economist Joseph Schumpeter. He didn’t use the word itself, but he wrote influentially on a phenomenon that he called “creative destruction”. Where capitalism inherently destroys old industries and economic systems in the process of innovating new ones.

So, Schumpeter identified industry disruption as an inherent pattern in capitalism. Successive cycles of invention create new industries while destroying their predecessors.

But it was Clayton Christensen who build the first theory of how disruption happens and began to investigate into its mechanisms. His brilliant theory of disruptive technology (later renamed disruptive innovation) was laid out in a 1995 article and subsequent book, The Innovator’s Dilemma.

Digital pure players’ threat for disruption

New technologies make it possible for new challengers and disrupters to enter the market. Business disruption happens when an existing industry encounters a challenger that offers a far greater value to the customer in a way that existing companies cannot compete with.

Really, in the digital age, relying on an unchanging value proposition is inviting challenge and eventual disruption by new competitors.

Surely, the only relevant response to a shifting business environment is to take a path of constant evolution, looking to every technology as a way to extend and improve your value proposition to your customers.

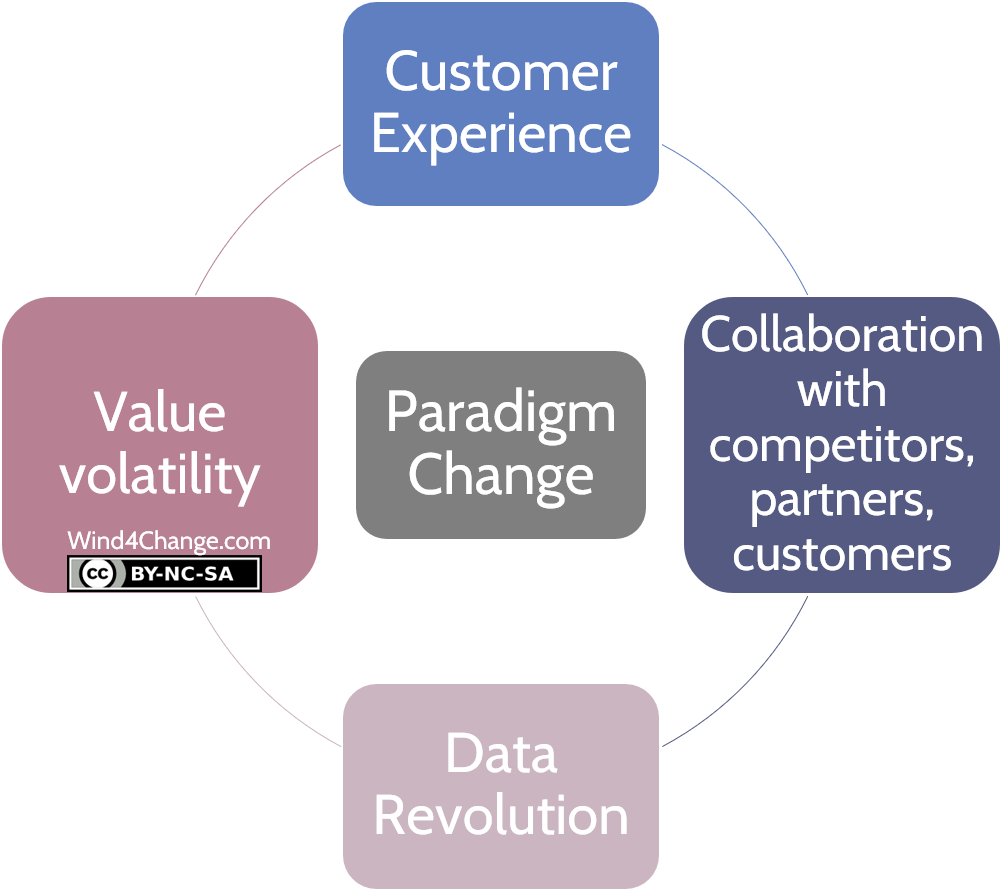

Value Volatility: a Paradigm Change with Digital

Actually, the disruption is more than a one shot or a recurrent threat. Truly, it is a change of Paradigm: Value is now volatile, transient.

Cash cows generate a smaller share of total profits (25 per cent lower than in 1982) and are proportionately fewer with the lifespan of this stage declining (by about 50 per cent depending on the industries).

And technologies makes the difference to build and deliver the value so you need to manage them closely.

Certainly, the life cycle of a technology Invention is a lot like surfing. You have to catch the wave at the right time.

Traditionally, strategy and innovation have been two autonomous fields:

- Strategy was all about targeting a advantageous position in a well-defined industry and then harvesting a long-term competitive advantage.

- On the contrary, Innovation was about creating new businesses and was considered as something distinct from the business’s core activities.

Strategy and innovation need today to come all together. Indeed, they are driven by the need for far greater adaptability in order to win in a world of transient competitive advantage. Surely, every company now needs to think more like a startup.

How to face the challenge of Value Volatility coming with Digital?

Innovate fast to evolve your product and business model for better opportunities

- Discover new customers and applications for your current products

- Evolve your business’s offering while your old business model is under severe threat (e.g. Encyclopædia Britannica has re-envisioned itself as an educational resource)

- Develop a new suite of products in anticipation of rapid customer changes

- Experiment new ways to engage customers while they are still loyal

Increase differentiation

- At first, a difference in value proposition: price, ease of use, personalization, aggregation, social experience…

- Then, a difference in value business model: customer segments, channels, partners, complementary products or services, revenue and cost model, assets and all other items in a business model…

What’s next? Learn more about Digital, the other new paradigms and the disruptive technologies

Check my other posts on Digital and the new paradigms:

- Customer Experience

- Coopetition and platform business model

- Data revolution

- Value volatility (this post)

And how Agile fits in the digital picture.

Check my post about the disruptive technologies that are referred to.

Do you want to learn more about the Value Volatility? Here are some valuable references

Excellent books about Digital

- The Digital Transformation Playbook

- The website of the author David Rogers

- Building the Agile Business through Digital Transformation

- The website of the author Neil Perkin