Review the 12 principles of Beyond Budgeting and the commonalities with Agile at Scale. Then, understand how and why Beyond Budgeting reconsiders traditional budgeting.

Beyond Budgeting is an approach to make the budget process agile. To begin with, first evidences of the Beyond Budgeting approach started in 1972 in a Swedish bank, Handelsbanken bank. Then, Statoil, a Norwegian state-owned petroleum company, implemented Beyond Budgeting in 1997. The name of this company is today Equinor and it covers more energies that just oil.

- Traditional budgeting process

- Beyond Budgeting vs Traditional Budgeting as in Beyond Budgeting from Jeremy Hope and Robin Fraser

- The 12 principles of Beyond Budgeting: the budgeting reconsidered

- Beyond Budgeting Tooling

- What’s next? Learn more about Agile at Scale

- Do you want to learn more about Beyond Budgeting, Balanced Scorecard and OKRs? Here are some valuable references

Traditional budgeting process

Myths in management thinking

Surely, traditional management has some beliefs that directly impact the related traditional budgeting process.

Control myth

No centralized control => Chaos and anarchy

No budget => Cost explosion

I can explain => I have control

More details => More quality

Performance myth

Good performance => Hitting the budget numbers

No individual bonus => No performance

The reality of the traditional budgeting

Because of these beliefs, the budgeting process became a tool:

- Firstly, to control and manage by the numbers.

- Secondly, a contract for all managers in the hierarchy to commit to financial outcomes even when most of the parameters are beyond their control.

The “budget contract” gathers:

- Firstly, a fixed target, usually sales, profits, costs, and ratios such as return on capital.

- Secondly, an incentive or reward.

- Thirdly, an fixed plan.

- Fourthly, a statement of resources allocated to deliver this plan.

- At last, a reporting schedule and approach to explain variance, fill the gaps to the plan and update forecasts.

The problem with traditional budgeting

A barrier for good performance

Traditional budgeting:

- Do not properly support strategy. Indeed it is poorly connected to strategy, and KPIs even when connected to the strategy are a simplification of it. Furthermore, the contract that the budget becomes, prevails strategic imperatives.

- Is not flexible enough and leads to micro-management.

- At last, is not action-oriented as it is backward, explanation oriented and is structured by department rather than activity.

A toxic mixture

Indeed, traditional budgeting tries to combine:

- Target setting

- Forecast

- Resource allocation

As a result, the objectives of all these dimensions are spoiled:

- As a matter of fact, targets must be ambitious, but forecasts realistic. Therefore, they cannot be the same number.

- Surely, mixing targets, forecasts, and resource allocation creates gaming. As a result, information distorts and decisions become political.

Gaming the numbers

In truth, 2/3 of the budgeting process is influenced by politics more than by strategy.

To illustrate, here are typical gaming examples in the budgeting process.

Target:

- Always bargain the lowest targets and the highest rewards.

- Then make the bonus, whatever it takes.

- And just meet the numbers, never beat them.

- At last, never take the risk of taking an initiative: if it’s not in the budget, then forget it even if it is good for the strategy.

Forecast:

- Never provide accurate forecasts.

- Then always have a story to explain financial variances even if it is not the true reason. Indeed, the root cause may not be obvious and may even be outside the department.

Resource:

- Always ask for more resources than you need. In addition, this will be a security for your needs when likely cut back comes.

- Then make sure to spend what is in the budget.

Cooperation:

- At last, cooperation is also at stake. Never share knowledge or resources with other teams. Certainly, they are competition…

Beyond Budgeting vs Traditional Budgeting as in Beyond Budgeting from Jeremy Hope and Robin Fraser

Target

| Traditional Budgeting | Beyond Budgeting |

|---|---|

| Equal to plan: what we can deliver with the budget. KPI targets. Absolute target. | Aspiration driven: what we must deliver. Target comes before plan. Ambition to action that consist in: Strategy&Target, Planning and Holistic&Relative Performance Evaluation. Relative targets. |

Plan and Forecast

| Traditional Budgeting | Beyond Budgeting |

|---|---|

| Plan = target, forecast and resource allocation. Gaps vs targets hidden. One outcome only. Very detailed. | Plan = forecast only (actions and expected performance). Gaps vs targets visible. Main uncertainty spans. Less detailed. |

Note that forecast in Beyond budgeting:

- Firstly, is action based.

- Secondly, covers expected outcome and early warning.

- At last, is both financial and non financial.

Resource allocation

| Traditional Budgeting | Beyond Budgeting |

|---|---|

| Annual pre-allocation through budget. Budget: an entitlement, “my money”. | No pre-allocation. Projects triggered based on decision gates and criteria. Operations: relatives KPIs. Monitoring: intervention if needed only. |

Business reporting

| Traditional Budgeting | Beyond Budgeting |

|---|---|

| Backward looking. Variance vs year-to-date budget. | Forward looking. Forecast vs targets and actions to close gaps. |

Evaluation/reward

| Traditional Budgeting | Beyond Budgeting |

|---|---|

| Based on budget figures and KPI targets. | Broader evaluation: ambition to action and behavior. |

The 12 principles of Beyond Budgeting: the budgeting reconsidered

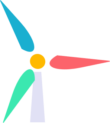

The first 6 principles of the 12 principles of Beyond Budgeting are about the leadership stance, what Jeremy Hope and Robin Fraser call the radical decentralization, in the book Beyond Budgeting. Truly, those principles are at the core of Agile.

Leadership and Delegation principles: the Radical Decentralization

Customers Focus

Everyone should focus on improving customer outcomes, especially the front-line teams in direct contact with the customers. Really, satisfaction of the customers should be the priority, in the limit of the profitability. On the contrary to traditional organization, hierarchical relationships should come in second.

Transparency

Transparency is also a key element in Agile. Open information is the prerequisite for alignment and self-management. In addition, it promotes ethical behavior. Clearly, it is a major change for most of the organization where information is power and is restricted at each level of the hierarchy.

Values, Goals and Boundaries

The second prerequisite to support alignment and self-management is the frame provided by company values, goals and boundaries. Agile and especially Agile at Scale leverage the same to enable alignment and empowerment. In addition, the leadership should support a high performance culture. In other words, high expectations lead to repeated successes and sustainable competitive advantage. Yet, this requires Psychological Safety and a sustainable pace to last. Instead, traditional organization focuses on detailed rules and budgets.

Decentralization

Agile teams are small even when scaling Agile. Surely, this is the same principle here to rely on accountable small teams. Not on centralized functions. In other words, the central tells the outcome expected, the local takes care on how to achieve it. But decentralization comes with federalism. To illustrate, clear principles set the boundaries and provide guidelines for local decision making. This includes:

- Firstly, the culture and values of the company.

- Secondly, common decision criteria for a given business and a clear delegation mandate. Even if all businesses are specific, use in Agile is to make explicit decision criteria. This is what we call a Business Value Model.

- At last, a common accounting system to enable information sharing and consolidation.

Responsibility

Like in Agile, individuals and teams are empowered and are granted responsibility. As a result, with responsibility the teams are more committed, efficient and create more value. Indeed, they act proactively and adapt, not just follow the plan.

Autonomy

The last principle of leadership and decentralization is close to the previous one. Surely, with responsibility comes autonomy. In fact, this is another principle of Agile. The Leadership gives the teams the freedom and capacity to act. Whereas traditional organization micromanages them. Autonomy with responsibility support motivation then commitment. Nevertheless, as we have reviewed in the decentralization principle, this delegation structures within a frame.

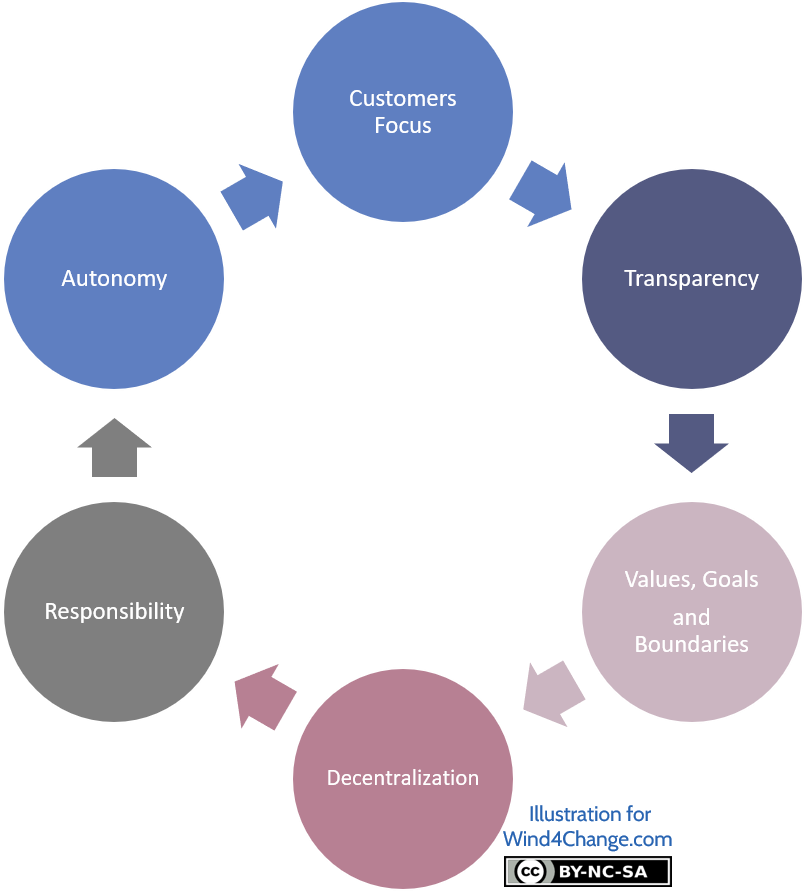

Beyond Budgeting process principles

The next 6 principles of the 12 Beyond Budgeting principles are about the budgeting process itself.

Goals

Goals are relative and are usually set comparatively to peers. So, goals can be stretched as they are an ambition, not a mandatory target. In addition, they are outcome-based like return on equity and cost-to-income. Clearly, they are not like in traditional budgeting, a fixed performance contract. Nevertheless, evaluation and/or reward can be connected to them.

Rewards and Evaluations

Rewards are evaluated based on relative performance. Truly, they are not about meeting fixed targets. In fact, performance is at the end about outperforming peers. To illustrate, no sport team would define their target as a number of points but as beating the competition. As a result, the organization eliminates the time-intensive target negotiation and the need for imposing targets from the top. Indeed, each business unit and related teams set their goals knowing that they will not be used to measure them. Surely, benchmarking is self-regulating. It uses positive peer pressure to steer performance. At last, performance evaluation is a holistic assessment of the delivery and the behavior.

Planning

Beyond Budgeting comes back to the core purpose of planning:

- Firstly, identifying which actions to take into account in order to deliver the strategic objectives and KPI targets.

- Secondly, understand the expected consequences of actions, expressed as a forecast.

Furthermore, planning becomes a continuous and inclusive process instead of a top-down annual event. At last, with data used by people who generate them, they improve in quality.

Controls, aka Reviews

Controls, better called Reviews, leverage relative indicators and trends. Unlike traditional budgeting, it is not on variances against plan. In addition, there is a switch for the control to be forward looking and action oriented.

Resources Allocation

Beyond Budgeting makes it possible to move away from a rigid annual allocation to an on-demand allocation when needed. But Agile at Scale goes further as the capacity is stable. Indeed, there is in Agile at Scale a change of paradigm as the approach is to maximize the value for a given business perimeter with a stable capacity allocated.

Dynamic cross-company coordination

At last, coordination leverages decentralization and autonomy of the teams that interact dynamically. So, the organization can move away from an inefficient synchronization through annual planning. Without a doubt, Agile at Scale provides synchronization mechanisms depending on the level of dependency between teams working on the same business objective.

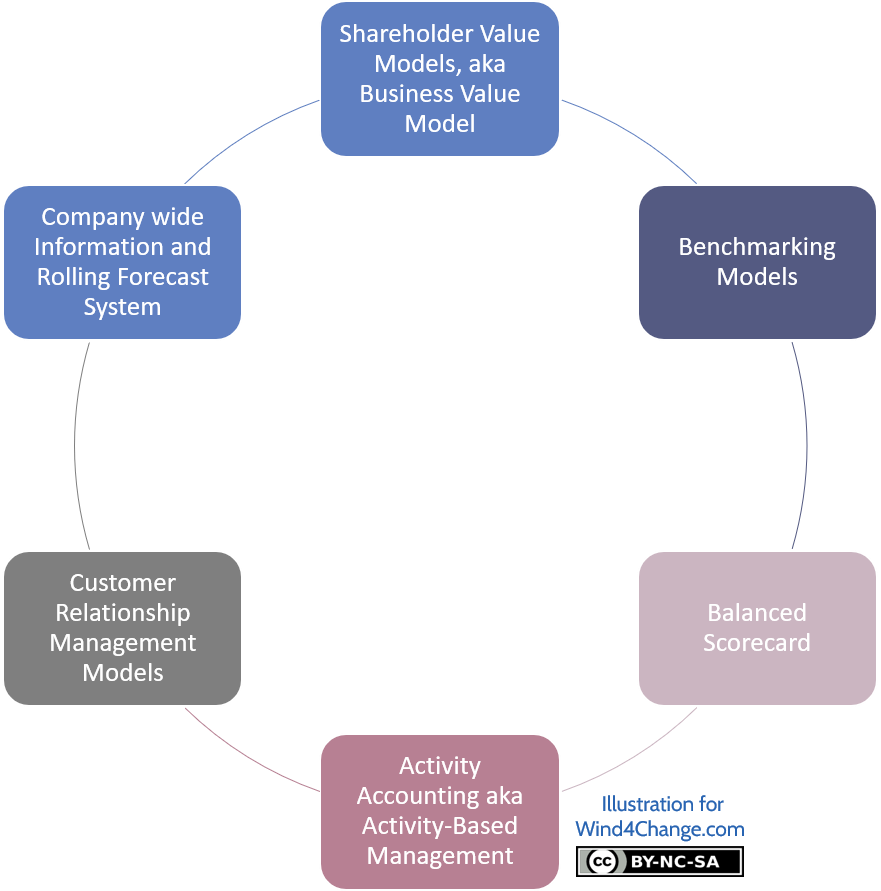

Beyond Budgeting Tooling

Beyond Budgeting provides a set of tools to support its dynamic and adaptive process.

Shareholder Value Models, aka Business Value Models

In their book Beyond Budgeting, Jeremy Hope and Robin Fraser introduce the Shareholder Value Models aka value added (EVA) and Value-Based Management (VBM) that enable managers to make decisions based on creating value greater than the cost of investment.

Business Unit and teams identify alternative options as part of defining their strategy. So, the Shareholder Value Model or the alternative, the Business Value Model, help them evaluate options and choose those with the highest value. Nevertheless, information needs to be remapped from the vertical flow of traditional accounting to the horizontal flow of a value-based and value chain system.

Benchmarking Models

Benchmarking Models are the enabler for continuous improvement against best of class peers. When used positively, Benchmarking Models motivate to quick and continuous improvement. In other words, teams think they can do it because it has been done by peers.

Balanced Scorecard

The Balanced Scorecard was designed and developed by Robert Kaplan and David Norton in the early 90s. Indeed, they wanted to improve performance measurement as it was, at the time, only based on reporting financial results against the budget.

So, the Balanced Scorecard should tell the story of a business unit’s strategy. In addition, it is a tool to help teams align their goals and actions with the strategy. Really, the power of the Balanced Scorecard is that it trades completeness against simplicity and clarity. ThiS makes it quite actionable. At last, Balanced Scorecards cascade and align from top to bottom to enforce consistency of goals and actions, at all the levels of the organization.

Here, we will consider the Balanced Scorecard in a Beyond Budgeting context. Indeed, a Balanced Scorecard can adapt to be future oriented. In addition, peer benchmarking can be used for evaluation and reward instead of the Balanced Scorecard.

A Balanced Scorecard structures over 4 dimensions with the related questions:

– Financial goals: “What are our financial goals impacting our organization?”

– Customer goals: “What is important to our customers, which will, in turn, impact our financial goals?”

– Internal Process goals: “What do we need to do well internally, in order to meet our customer goals?”

– Learning and growths: “What skills, culture, and capabilities do we need to have in our organization to execute on our processes, so our customers will be satisfied?”

A Balanced Scorecard includes Objectives, Measures, Initiatives, and Indicators.

What is the difference between the Balanced Scorecard and the OKRs?

Andy Grove, co-founder of Intel, created the OKR system. John Doerr, Andy Grove’s mentee, has popularized the OKR throughout the Silicon Valley and then beyond with his book “Measure What Matters”.

Both OKRs and Balanced Scorecard are systems to steer change. They both seek to communicate transparently what a team or an organization is trying to achieve, align its goals and actions with the strategy, and measure progress toward its goals.

| Balanced Scorecard | OKRs |

|---|---|

| Holistic over 4 dimensions: Financial, customer, Internal Process, Learning and Growth. Set annually. 10-15 objectives and 1-2 measures per objective. | Strategic and potentially can be changed if objectives become obsolete. Set quarterly. Maximum of 3-5 Objectives and 3-5 Key Results (equivalent of Balanced Scorecard measures). |

OKRs and the Balanced Scorecard complement each other. Firstly, OKRs can help to define Objectives from the Balanced Scorecard. Secondly, if part of the objectives are top-down and the Balanced Scorecard enforces alignment and consistency with the strategy, the other part of the objectives should be bottom-up. So, the OKRs address this need and, at the same time, support anchoring of the strategy in the field and the specificity of the teams.

At last, OKRs may be used without Balanced Scorecard when reaching the lower level of an organization where steering with a Balanced Scorecard makes less sense.

Activity Accounting, aka Activity-Based Management

In Beyond Budgeting as there is no longer comparison of costs with a budget, there is a need to understand better actual costs. Indeed, activity accounting is about understanding the purpose of costs. Not just the type of costs (accounts) and where they occur (cost centers) but how costs vary with activity. Clearly, each action has a purpose. As a consequence each cost can be related to an objective. So, accounting introduces new dimensions providing more relevant information: what, who and why. Therefore, it makes the connection between activity, drivers and objectives usually captured at product or client level. Clearly, this gives the big picture of the true profitability.

Customer Relationship Management Models

Customer relationship management models enable understanding the customers’ behavior. In other word, customer relationship management models identify what the company needs to do, to fully meet customer’s satisfaction, but also to build their loyalty and profitability.

Company wide Information and Rolling Forecast System

In traditional companies, information systems reflect the organizational hierarchy. Indeed, information flowed up and down the functional lines. Beyond Budgeting aims to consolidate and share the information cross company whatever the department. In addition, it makes sense even in organization aligned on the Value Chains like in Agile at Scale. Surely, some initiatives may be cross business line and there is a need for consolidation of the information to the top.

Benefits are to provide fast actual figures, rolling forecast and enable activity and market intelligence.

What’s next? Learn more about Agile at Scale

Check my other posts about Agile at Scale:

- Review my posts on Agile at Scale foundations:

- What are

- What are the team topologies?

- How to synchronize Agile Squads in Agile at Scale when there are dependencies?

- Check another of my posts introducing Agile at Scale that leverages the book “Doing Agile Right”.

- Review my post on the Agile best practices from the GAO the Government Accountability Office from the USA.

- Read my posts on advanced topics around Agile at Scale:

- What are Leagues in Agile at Scale?

- How to design Agile Squads so they are aligned on the Value Chains.

- Why going for horizontal management? What does it mean and what is the value?

- How roles are reallocated with Agile at Scale?

- Check my posts on project management in Agile at Scale

- What is the impact of Agile on Project Management?

- How does Project Portfolio Management change with Agile at Scale?

- Then, how does Cost of Delay Divided by Duration (CD3) contribute to Agile at Scale?

- How does Beyond Budgeting support Agile at Scale?

- Can an Agile Project be fixed price?

- How to manage Release Management in Agile?

- Review my posts on how to forge a good strategy:

- What are competition and competitive advantage?

- What is a good strategy?

Do you want to learn more about Beyond Budgeting, Balanced Scorecard and OKRs? Here are some valuable references

The reference books about Beyond Budgeting

- Beyond Budgeting from Jeremy Hope and Robin Fraser

- Implementing Beyond Budgeting from Bjarte Bogsnes

Some good posts about Beyond Budgeting

- Post on Beyond Budgeting from ACCA (Association of Chartered Certified Accountants)

- Whitepaper on Beyond Budgeting from CIMA (Chartered Institute of Management Accountants)

- Whitepaper Beyond Budgeting: Boon or Boondoggle? from Robert C.Rickards

- Whitepaper Beyond budgeting or budgeting reconsidered? from Theresa Libby, and R. Murray Lindsay

Some good posts about the Balanced Scorecard, OKRs and the difference between them

- Wikipedia post for Balanced Scorecard

- Wikipedia post for OKRs

- HBR post, The Balanced Scorecard—Measures that Drive Performance, by Robert S. Kaplan and David P. Norton

- HBR “best of” paper, Using the Balanced Scorecard as a Strategic Management System, by Robert S. Kaplan and David P. Norton

Balanced Scorecard described in the next referred post, is one from a traditional top-down organization that does not use Beyond Budgeting. Indeed, we have adapted the Balanced Scorecard in this post to take into account a Beyond Budgeting context.