Why a post on Competitive Advantage and Competition? Without a doubt, Agile at Scale makes it possible to fully align the delivery capacity to the objectives. Indeed, the Product Management Team at the level of the Tribe and the Product Owner at the level of the Agile Squad, define the prioritizes and validate the output. But are the priorities properly set? How to be sure that the focus is on what matters most? And how to define what matters most?

As a result, this is where Strategy gets in. The first step to forge a good Strategy is to understand what is Competition and how to build a Competitive Advantage.

- What is the good strategy to build a Competitive Advantage and face Competition?

- How to assess market competition? Discover Michael Porter's 5 Forces Model

- How to assess the company's Competitive Advantage in comparison to Competition? Explore Michael Porter's Value Chain Analysis

- What's next? Learn how to forge a good Strategy!

What is the good strategy to build a Competitive Advantage and face Competition?

How is Strategy to be the best a trap?

In war, there can be only one winner. The enemy should be destroyed or at least neutralized for good. In business, however, you can win without eradicating your rivals. In fact, competing to be the best is bound to a destructive competition where no one can win. This kind of competition is a zero-sum game when offerings converge.

In this approach to be the best, companies pursue the illusive scale advantage to be big enough. Surely, as they do, they may compromise their own performance. To illustrate, they cut price to get volume, they overextend themselves to serve all market segments, and they acquire overpriced companies.

Lower prices benefit to customers, but they are bad for companies as they result in lower profits. Indeed, customers may take advantage of lower prices as competitors copy and match each other’s offerings. As a consequence, they usually have to give up choice.

The truth, is that the real point about competition is not to beat rivals: it’s to earn profits.

How to assess market competition? Discover Michael Porter’s 5 Forces Model

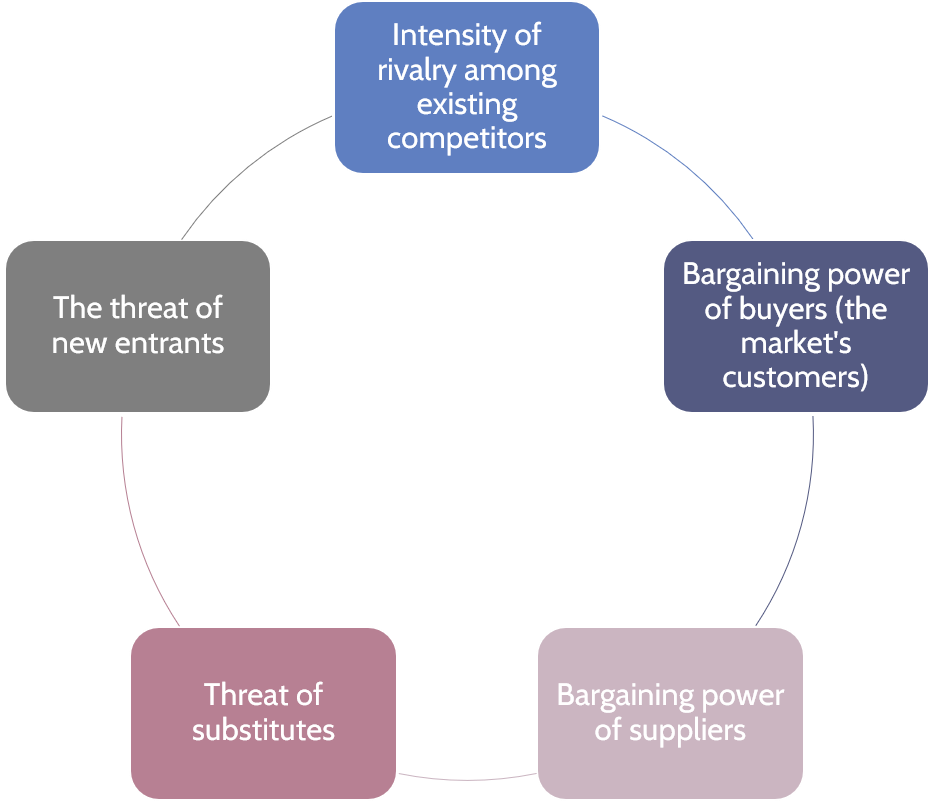

Michael Porter built a model to analyze the competition five forces in a given market.

As a matter of fact, this analysis of the market structure explains how the economic value created in this market is divided, how much is captured by companies versus the five forces: customers, suppliers, distributors, substitutes, and potential new entrants.

The 5 forces in market competition

Competitors

The intensity of rivalry among existing competitors:

- If the competition is high, then companies struggle away the value they create, passing it to buyers in lower prices or dissipating it in higher costs of competing.

Customers

The bargaining power of buyers, the customers of the market:

- Powerful buyers will push prices down or will demand more value in the product.

- Surely, buyers are more likely to use their negotiating leverage if they are price sensitive. This is the case when what they are buying:

- Is not differentiated.

- Is expensive relative to their other costs or income.

- Has low impact on their performance.

Suppliers

The bargaining power of suppliers:

- Powerful suppliers will charge higher prices or insist on more favorable terms, lowering market profitability.

Substitutes

The threat of substitutes:

- Products or services that meet the same basic need as the market’s product in a different way, put a cap on the market profitability.

New entrants

The threat of new entrants:

- Entry barriers protect a market from newcomers who would add new capacity and capture market share. The threat of entry decreases profitability:

- It caps prices, because higher market prices would make entry more attractive for newcomers.

- Therefore, incumbents have to spend more to satisfy their customers to discourage new entrants.

How to assess the company’s Competitive Advantage in comparison to Competition? Explore Michael Porter’s Value Chain Analysis

How to review company’s Competitive Advantage?

Here are overview key questions to ask to have a first evaluation your Competitive Advantage:

- How profitable are each of the company’s businesses compared to the market?

- Why the company’s businesses under-perform or over-perform the market?

- How relative price and relative cost explain this difference of performance?

- Is there a price premium? What are the company specifics that enable this price premium?

What is a Value Chain?

A Value Chain is the sequence of all business activities required to design, build and deliver a product or a service to the customers. To illustrate, activities usually mix people, technology, fixed assets and information.

How to use Value Chain Analysis to investigate in detail company’s Competitive Advantage?

When a company has a Competitive Advantage over its rivals, it operates at a lower cost. In addition, it is able to differentiate and therefore charge a premium price, or both.

The Value Chain is a powerful tool to split a company into its key activities in order to identify the sources of Competitive Advantage. These activities are the enablers for higher prices or lower costs compared to the market.

Capturing then reviewing a Business Value Chain makes it possible to see and understand how activities are performed differently. Clearly, this allows a differentiation of the offer from competitors or a better matching of activities to the customer expectations. On the other hand, other activities may be dropped or reduced leading to a lower cost. In addition, activities can be performed by entities external to the company.

The steps to leverage the Value Chain to investigate the company’s Competitive Advantage are the following:

- Start by displaying the market’s value chain.

- Compare the company’s value chain to the market one.

- Identify the activities that enable differentiation then price premium.

- Spot the activities that represent the main part of costs.

What’s next? Learn how to forge a good Strategy!

Check my other post about designing a good and efficient Strategy.

To go further, sources of this post

Books:

- Competitive Strategy – Michael E. Porter

- Competitive Advantage – Michael E. Porter

- Understanding Michael Porter: The Essential Guide to Competition and Strategy. – Joan Magretta

Websites:

- Harvard Business Review post on “How Competitive Forces Shape Strategy” from Michael Porter

- Harvard Business Review video: The Explainer, Porter’s Five Forces